September 27 is marked in Turkmenistan as the Independence Day. On 12 December 1995, the United Nations General Assembly adopted Resolution 50/80, officially recognising and endorsing Turkmenistan's status of permanent neutrality. Two decades later, in June 2015, the General Assembly reaffirmed its support through Resolution 69/285, reinforcing the nation’s enduring adherence to neutrality – a status that is also firmly enshrined in Turkmenistan’s Constitution as the foundation of both its domestic and foreign policy frameworks.

Turkmenistan is a democratic, law‐based and secular state governed as a presidential republic.

Constitution and State Structure

The political framework of Turkmenistan is established by its Constitution, adopted on 18 May 1992 and revised on 14 September 2016. This fundamental law provides that the state is organised on the basis of a separation of powers among the legislative, executive, and judicial branches, each operating independently to maintain a system of checks and balances. Norms and provisions enshrined in the Constitution are directly applicable, while any laws or legal acts that conflict with it are rendered null and void. The people of Turkmenistan are recognised as the sovereign authority and the sole source of state power.

Executive Branch

The President, as the highest-ranking official, serves as both Head of State and head of the executive branch. The President chairs the Cabinet of Ministers, which constitutes the government, and is the guarantor of the country’s independence, neutral status, territorial integrity, respect for the Constitution, and fulfilment of international obligations. In addition, the President is the Supreme Commander of the Armed Forces.

Representative Bodies

The Halk Maslahaty is the highest representative democratic body. Its primary objective is to ensure broad public involvement in addressing matters of national importance, implementing reforms and socio-economic programmes, and developing proposals that promote unity, cohesion, tranquillity, prosperity, and the dynamic development of an independent and permanently neutral Turkmenistan. This body is presided over by its Chairman.

The Mejlis, Turkmenistan’s unicameral parliament, is the representative legislative body. It consists of 125 deputies elected from constituencies with approximately equal numbers of voters, each serving a term of five years.

Judiciary

Judicial power is vested exclusively in the courts, which are tasked with safeguarding the rights and freedoms of citizens as well as protecting the legally recognised interests of the state and society.

Territory

Turkmenistan spans an area of approximately 491,210 square kilometres, extending 1,100 km from west to east and 650 km from north to south. It is bordered by the Republic of Kazakhstan to the north, Uzbekistan to the north‐east and east, the Islamic Republic of Afghanistan to the south‐east, and the Islamic Republic of Iran to the south. To the west, the Caspian Sea forms its natural boundary, through which it shares a border with the Republic of Azerbaijan.

Population

As of December 2022, the population of Turkmenistan exceeds 7 million. The country is multinational, with more than 100 distinct ethnic groups residing within its borders.

Language

Turkmen is the official language, and all citizens are guaranteed the right to use their native tongue. Educational institutions ensure instruction in Turkmen, English, and Russian. Furthermore, higher education institutions and certain specialised secondary schools offer courses in French, Chinese, German, Japanese, and other foreign languages.

Currency

The national currency is the Turkmen manat, which was introduced into circulation on 1 November 1993.

The Government Programme for the Development of the Banking System for 2011–2030 was adopted and has been successfully implemented. In recent years, Turkmenistan’s financial institutions have undertaken extensive efforts to develop the securities market. At present, banking services are provided to the population through cards such as Visa, Visa Electron, and Visa Classic. Furthermore, banks are actively working to introduce international payment cards, notably the MasterCard system, to promote non-cash transactions in the trading sector.

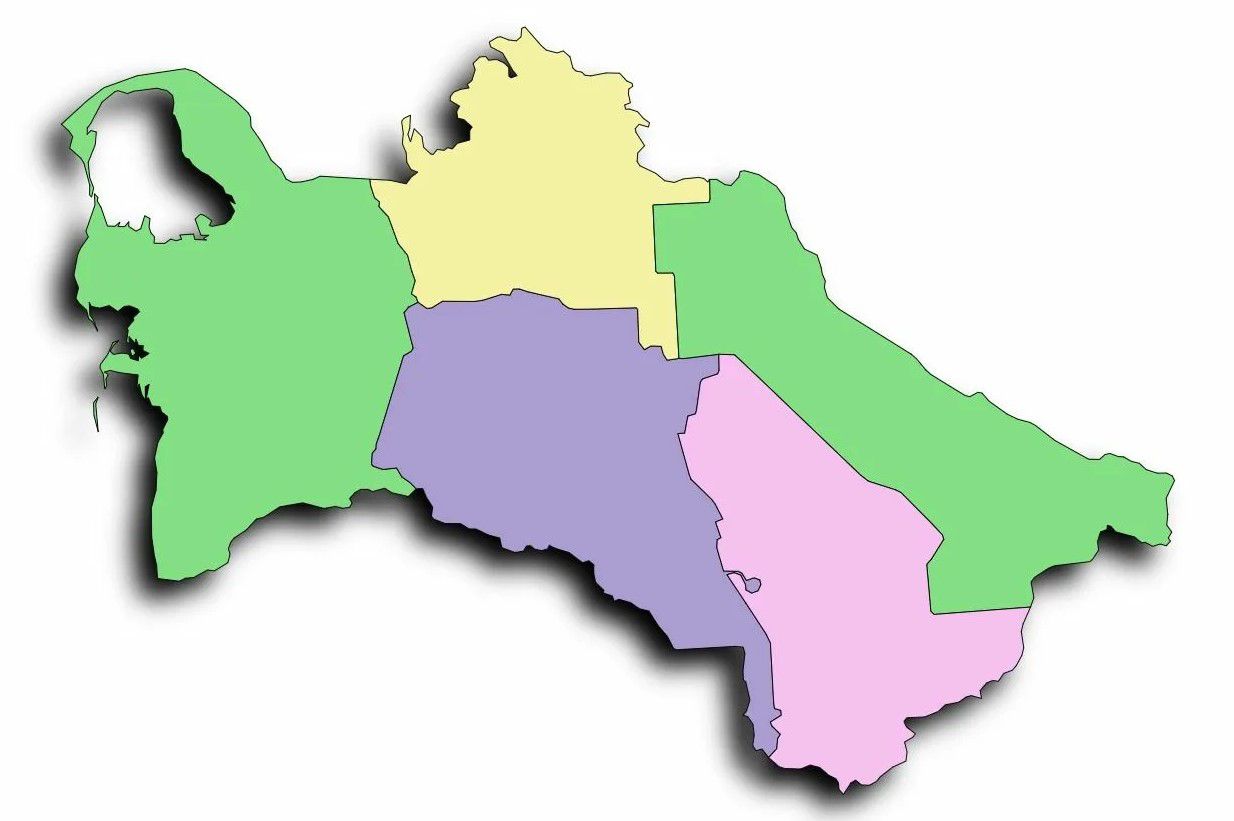

Administrative and Territorial Organisation

Ashgabat, the capital, is an administrative and territorial unit with province-wide authority (velayat). In addition, the ‘smart’ city of Arkadag, located ne

ar Ashgabat, is planned to develop into a major urban centre focused on modernisation and growth. Turkmenistan is divided into five provinces – Ahal, Balkan, Dashoguz, Lebap, and Mary – which are further subdivided into districts. In total, there are 43 districts, six etraps within towns, 51 towns (including 11 with etrap status), 62 villages, 605 rural councils (municipal units), and 1,719 rural settlements

KEY DIRECTIONS OF TURKMENISTAN’S INVESTMENT POLICY

Turkmenistan’s investment policy is centred on fostering a favourable environment for investment activities across state-owned, private, and foreign enterprises. The overarching objective is to enhance economic diversification, technological advancement, and sustainable development through strategic investments in key sectors.

Energy Sector

In the oil and gas industry, the investment strategy prioritises:

- Expanding Turkmenistan’s energy export routes by developing a robust pipeline network and fostering long-term partnerships with leading international companies.

- Enhancing the exploration and development of hydrocarbon reserves both onshore and offshore in the Caspian Sea to increase production capacity, processing efficiency, and export potential.

Chemical Industry

Investment efforts focus on scaling up chemical production through the construction of modern industrial complexes for the manufacturing of urea, phosphorus fertilisers, caustic soda, iodine, chlorine, bromine, and their derivatives. This initiative aims to strengthen the country’s position in global chemical markets.

Textile Industry

The investment policy in the textile sector is designed to:

- Boost domestic processing of cotton fibre by establishing high-value-added textile enterprises.

- Introduce advanced production technologies to enhance product competitiveness in both domestic and international markets.

- Reduce reliance on raw cotton exports by increasing the share of finished textile goods.

Industrial Diversification

A core strategic objective is the diversification of the industrial base by developing both export-oriented and import-substituting industries that utilise domestic raw materials. This approach enhances economic resilience and reduces dependency on external suppliers.

Agriculture and Agribusiness

The investment framework in the agricultural sector is directed towards:

- Expanding the production and processing of grain, cotton, wool, and leather.

- Increasing domestic output of meat, dairy products, fruit, vegetables, and melons.

- Enhancing livestock and poultry farming through improved feed production and infrastructure development.

Transport and Logistics

Infrastructure modernisation remains a key priority, with investments focused on:

- xpanding and upgrading road, air, rail, river, and maritime transport networks.

- Establishing modern logistics hubs to strengthen Turkmenistan’s role as a regional transit corridor.

- Advancing digital communication systems, including electronic document management and digital broadcasting.

Social Development

Investment policies in the social sector aim to improve living standards and employment opportunities by creating a conducive business environment that stimulates job creation. Planned investments include:

- Modernisation and construction of hospitals, health centres, schools, sports complexes, and cultural institutions.

- Development of critical infrastructure such as water supply systems, sewage networks, housing projects, and hotel and recreation facilities

Private Sector Development

Encouraging private enterprise growth is a fundamental component of Turkmenistan’s economic policy. Investments are directed towards:

- Supporting the establishment and expansion of small and medium-sized enterprises (SMEs) in both export-driven and import-substituting industries.

- Facilitating the development of agricultural cooperatives (daikhan associations) to enhance productivity and market access.

By implementing these strategic investment initiatives, Turkmenistan aims to strengthen its economic competitiveness, attract foreign direct investment, and ensure long-term sustainable growth

LEGAL FRAMEWORK GOVERNING FOREIGN INVESTMENT AND ENTERPRISES WITH FOREIGN PARTICIPATION IN TURKMENISTAN

The legal regulation of the activities of foreign investors and enterprises with foreign capital within the territory of Turkmenistan is governed by the laws of Turkmenistan, including but not limited to: the Law of Turkmenistan "On Foreign Investments," the Law of Turkmenistan "On Hydrocarbon Resources," the Law of Turkmenistan "On Licensing of Certain Types of Activities," the Law of Turkmenistan "On Foreign Exchange Regulation and Currency Control in Foreign Economic Relations," as well as other legislative acts and international treaties to which Turkmenistan is a party.

Pursuant to the applicable legislation, foreign investment in Turkmenistan may take the following forms

- Participation in joint enterprises with legal entities and individuals of Turkmenistan;

- Establishment of enterprises wholly owned by foreign investors, branches of foreign legal entities, or acquisition of ownership rights in existing enterprises;

- Acquisition of movable and immovable property, except where restricted by the legislation of Turkmenistan;

- Extension of foreign loans and borrowings;

- Acquisition of proprietary and non-proprietary rights in accordance with the legislation of Turkmenistan.

Foreign investors are granted the autonomy to determine the size, composition, and capital structure of newly established enterprises.

Legal Protection, Guarantees, and Incentives

Turkmenistan ensures the legal protection of enterprises with foreign investment from the date of registration of the investment project. The state guarantees the following protections for foreign investments:

- Legal protection of foreign investors and their investments;

- Compensation in the event of requisition or expropriation of a foreign investor’s property;

- Right to export property and information in documentary or electronic form;

- Unhindered transfer of payments related to foreign investments;

- Protection of intellectual property rights;

- Right to transfer rights and obligations of foreign investors and enterprises with foreign investment to other persons;

- Repatriation of foreign investments upon the termination of investment activities.

To foster investment activity in Turkmenistan, foreign investors are eligible for various state incentives, including:

- Tax exemptions and reductions;

- Licensing benefits;

- Customs duty exemptions;

- Visa facilitation;

- Certification benefits.

Regulation of Free Economic Zones

The Law of Turkmenistan "On Free Economic Zones," adopted in October 2017, establishes the legal, organizational, and economic framework for the creation and operation of free economic zones within Turkmenistan.

Under this law, various categories of free economic zones may be established, including:

- Trade zones, such as free trade and export zones;

- Industrial production zones, including export-import and industrial parks;

- Technology and innovation zones, such as technology parks and technopolises;

- Service zones specializing in financial, banking, tourism, information, and other sectors;

- Transport and logistics zones, including port facilities;

- Agricultural zones;

- Comprehensive zones integrating multiple functional categories.

Participants of free economic zones are assured stability in the regulatory conditions governing investment and entrepreneurial activities within such zones, in accordance with the laws of Turkmenistan. The state guarantees the protection of the rights and legitimate interests of free economic zone participants, ensuring a stable and predictable investment environment.

FINANCIAL MONITORING SERVICE AT THE MINISTRY OF FINANCE AND ECONOMY OF TURKMENISTAN

The Financial Monitoring Service at the Ministry of Finance and Economy of Turkmenistan is the state authority established to prevent money laundering and terrorism financing. Created by presidential resolution № 934 on October 5, 2018, it operates under the Constitution, national laws, presidential acts, legislative resolutions, and international agreements, thereby demonstrating Turkmenistan’s commitment to UN conventions and international standards.

Governance and Legal Framework

- Establishment & Leadership: The Service is an administrative financial intelligence body led by a chairman appointed and dismissed by the President.

- Legal Basis: Its activities are founded on the Law «On Anti-Money Laundering and Combating the Financing of Terrorism» and accompanying regulations approved by the President.

Core Tasks

The Service’s primary objectives include:

- Implementing state policy to combat money laundering and terrorism financing.

- Contributing to the development and refinement of national legal frameworks by proposing improvements.

- Organizing and coordinating measures to assess, mitigate, and eliminate national financial risks.

- Coordinating the work of state bodies and managing technical assistance projects from foreign governments and international organizations.

- Establishing a unified information system and maintaining a database for monitoring financial transactions.

- Exchanging information with foreign authorities and representing Turkmenistan in international organizations.

- Defining thresholds for mandatory control of financial transactions and ensuring data confidentiality.

- Approving training programs for reporting entities and organizing related courses domestically and abroad.

Key Functions

To fulfill its mandate, the Service:

- Collects, processes, and analyzes information on financial transactions subject to mandatory control.

- Coordinates activities among state bodies and, upon request, provides necessary information to law enforcement and judicial authorities.

- Forwards suspicious transaction details to the Prosecutor General’s Office for further action.

- Participates in developing and implementing international cooperation programs and conventions.

- Harmonizes domestic practices with international standards, including recommendations from bodies like the Financial Action Task Force (FATF).

- Establishes internal control requirements, sets criteria for identifying suspicious activities, and maintains an automated system for monitoring financial operations.

- Drafts and updates norms, standards, guidelines, and training protocols to ensure continuous professional development in the field.

This streamlined overview preserves the original meaning and logical structure while providing a clear and comprehensive summary of the Service’s purpose, legal basis, and operational responsibilities.

THE CASPIAN ECONOMIC FORUM

The Caspian Economic Forum – marks a new chapter in regional economic cooperation and investment for the littoral states of the Caspian Sea. Conceived as an international platform, the Forum is dedicated to overcoming both geographical and informational barriers that have traditionally hindered large-scale investments in the region, and it is poised to play a pivotal role in harnessing the abundant natural resources and economic potential of the Caspian basin.

A Platform for Regional Collaboration

Launched in 2019 during a historic moment for the region, the First Caspian Economic Forum was held in the renowned tourist zone of Avaza, Turkmenistan. This inaugural meeting was strategically scheduled on August 12 – the anniversary of the Convention on the Legal Status of the Caspian Sea – to underline its significance and the commitment of the littoral states to establishing a lasting framework for cooperation. By inviting high-level representatives from the Caspian countries, the Forum has become a crucible for discussions centered on enhancing trade, securing investments, and initiating transformative projects that span energy, infrastructure, and tourism sectors.

Formation and Framework

The genesis of the Forum can be traced back to the V Summit of the Heads of the Caspian Littoral States, held in Aktau, Kazakhstan, in 2018. At this summit, Turkmenistan’s former President Gurbanguly Berdimuhamedov proposed the creation of the Forum as an institutional mechanism designed to stimulate and coordinate investment projects in the region. This proposal was well received by the coastal nations and laid the groundwork for the Forum's establishment. The strategic timing and location of the inaugural event in Avaza not only celebrated the region’s legal and historical milestones but also symbolized the renewed commitment of the Caspian states to bolster economic ties and improve connectivity in a region rich with potential resources.

Strategic Significance in a Resource-Rich Region

One of the Forum’s most compelling aspects is its focus on the vast natural wealth of the Caspian Sea. Estimates suggest that the Caspian basin holds roughly 50 billion barrels of oil and nine trillion cubic meters of gas – resources that, if fully exploited, could translate into economic benefits worth trillions of dollars. By fostering an environment that encourages the joint development of these resources, the Forum aims to create favorable conditions for major investment projects that can drive economic growth across the region. In doing so, it helps to align the interests of the Caspian states and ensures that investments are not only robust and secure but also sustainable and inclusive.

Looking to the Future

Building on the success and momentum of the previous events, it is expected to expand on the initiatives launched in 2025, further integrating regional markets and solidifying the Caspian Sea’s role as a major transit and investment corridor. By continuously refining and strengthening the framework for multilateral dialogue, the CEF aspires to become a permanent institution – a cornerstone for sustainable development and economic integration in Eurasia.

The Caspian Economic Forum stands as a testament to the proactive vision of regional leaders who recognize that collective action is essential for unlocking the enormous potential of the Caspian Sea with strategic investments, enhanced trade relations, and joint projects on the horizon, the Forum is not just an event – it is a catalyst for transforming the Caspian region into a dynamic and integrated economic powerhouse.